Tobacco Tax

Effectiveness of Tobacco Tax

Raising tobacco tax is considered as the single most effective tobacco control measure. With relatively low cost, this measure significantly reduces tobacco use and the economic burden associated with smoking. The World Health Organization (WHO) pinpoints that raising tobacco price and implementing tobacco tax as the prioritized measure to reduce smoking, in which every 10% price increase will reduce overall tobacco consumption by 4% in high-income countries and 5% in low- and middle-income countries. On the other hand, the World Bank suggests tax on tobacco products should account for two-thirds (67%) to fourth-fifth (80%) of the retail price. Thus, to further lower the smoking prevalence and enhance tobacco control in Hong Kong, there is an urgency to increase tobacco tax substantially and annually.

Regard to the information of the tobacco tax policy, rationales and recommendations of raising tobacco tax, please refer to the Factsheet on Tobacco Tax for more details.

Components of a strong tobacco tax policy

Tobacconomics is a United States institute which conducts economic research to inform tobacco control policies. It evaluates tax systems worldwide based on four components, namely cigarette price, changes in cigarette affordability, tax share and tax structure.

- Cigarette price: High cigarette price can reduce smoking. Tobacco tax should raise cigarette prices to a sufficiently high level to deter smoking.

- Change in cigarette affordability: Increased cigarette affordability can lead to increased smoking. The effectiveness of tobacco tax can be eroded overtime due to income increase and inflation. Tobacco tax should be increased regularly to reduce the affordability continually.

- Tax share: It refers to the proportion of tobacco tax in cigarette prices. Higher tax shares can prevent more revenue goes to the tobacco industry by raising the cigarette retail prices.

- Tax structure: Determines the effectiveness of tobacco tax in achieving the public health and tax revenue goals. Simple tax structures, especially uniform specific excise tax rate with an automatic tax increase, are more effective.

In short, a strong tobacco tax policy should be composed of high uniform specific exercise tax to raise the retail price and automatic tax increase to continually reduce affordability.

Rationales of Raising Tobacco Tax

- To reduce the disease and economic burden associated with smoking

- Every two chronic smokers, one will die prematurely, with an average loss of 10 years or longer of life expectancy.

- Smoking is the second major risk factor for global disease burden. Globally, tobacco kills more than 8 million people each year, in which around 1.2 million non-smokers are killed by exposure to secondhand smoke.

- In Hong Kong, smoking kills nearly 14,000 people annually, in which about 420 deaths are due to exposure to second-hand smoke.

- To motivate smokers to quit

- International evidence has shown that raising tobacco tax along with tobacco price could effectively enhance smokers’ motivation to quit.

- In Hong Kong, substantial tobacco tax increases can significantly motivate smokers to quit and enhance their quit intention and determination. Effectiveness of tobacco tax increment on the annual number of calls to the Integrated Smoking Cessation Hotline (1833183) is shown as below:

Effectiveness of increasing tobacco tax in promoting smoking cessation

Fiscal Year Tobacco Tax Integrated Smoking Cessation Hotline (1833 183) Number of Calls Annually 2009-2010 50% ▲ 258% 2011-2012 41.5% ▲ 49% Since 2015-2016 Unchanged ▼ 45% (Compared to the figures in 2019)

- To prevent youth from initiating smoking and quitters from relapse

- Youths have lower income than adults and are thus more price sensitive. Reduction in smoking due to the same price increase is 2 to 3 times higher in youths than in adults.

- Coincided with the 50% and 41.5% tobacco tax increase in FY2009-2010 and FY2011-2012 respectively, the youth smoking prevalence dropped from 6.9% in 2008 to 3.3% in 2013. It demonstrates the importance of stringent tax measures in motivating quitting and deterring smoking initiation among youths.

- To lessen the financial burden

- A research estimated that the total economic cost of smoking (from healthcare expenditures and productivity losses) was US$1,436 billion in 2012, equivalent in magnitude to 1.8% of the world’s annual gross domestic product (GDP).

- In Hong Kong, smoking causes significant healthcare expenditures and productivity losses, amounting to nearly HK$8.2-9.9 billion annual economic loss.

Tobacco Retail Price and Tax Rate in Hong Kong

- According to the duty rates prescribed in the Schedule to the Dutiable Commodities Ordinance (Cap. 109), the Hong Kong Customs and Excise Department is responsible for enforcing the law for collection of duties and protection of revenue. Duty shall be payable on tobacco at the following rates.

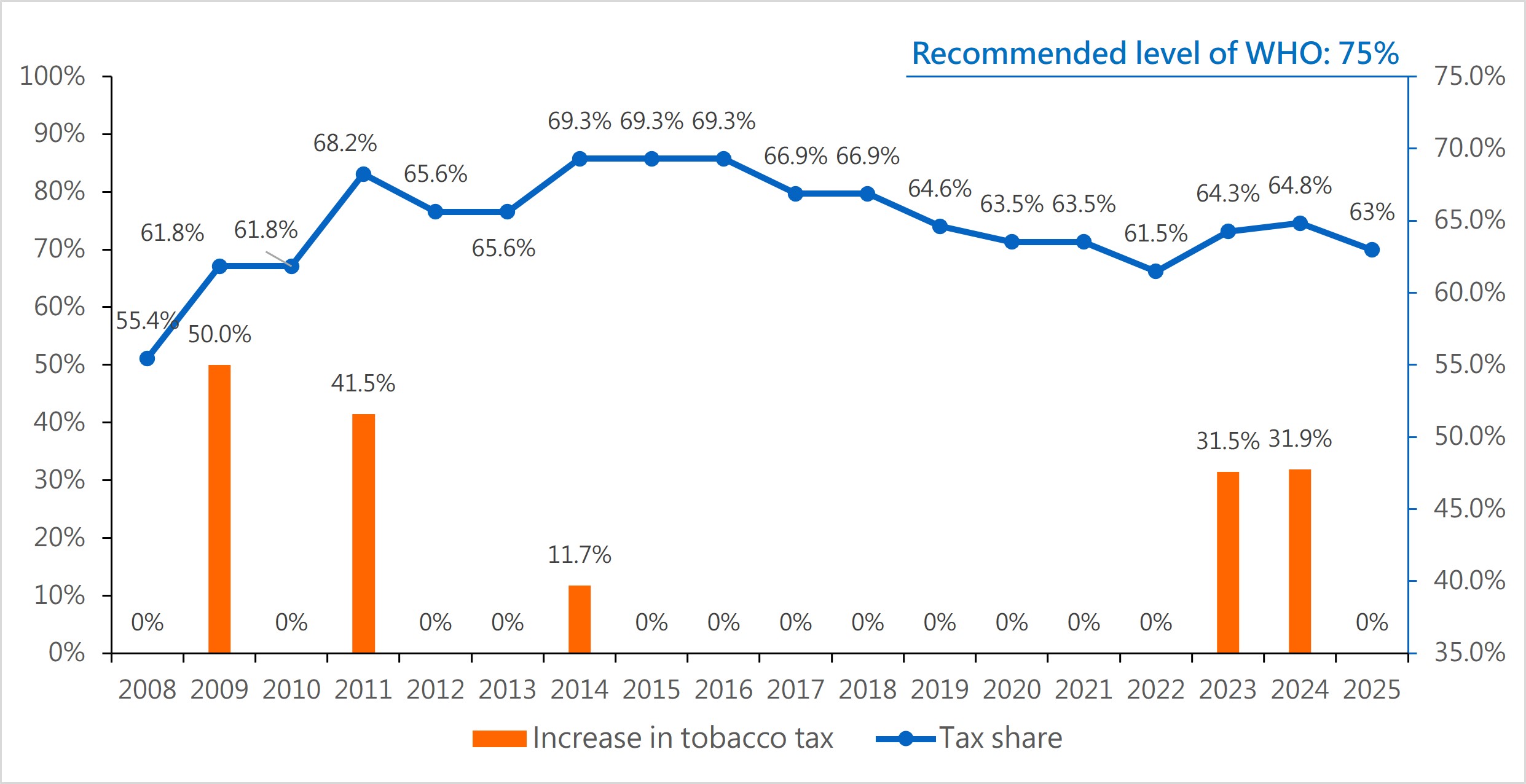

Tobacco Product Tax Rates Cigarettes $3,306/ 1,000 cigarettes Cigars $4,258/ kg Chinese prepared tobacco $811/ kg All other manufactured tobacco except tobacco intended for the manufacture of cigarettes $4,005/ kg - Tobacco tax rate was increased by about 31.5%(HK$0.6 per cigarette) in the 2023-24 Budget and about 31.9% (HK$0.8 per cigarette) in the 2024-25 Budget. The cigarette price of a pack of the major brands in Hong Kong is about HK$105, and the tobacco tax (about HK$66.1) accounts for only about 63%, which was still below WHO’s recommendation of at least 75%.

- Dr Hana ROSS, a world-renowned expert in tobacco control economics, advised that cigarettes in Hong Kong in 2022 were more affordable than those in 2009 after discounting the income growth and inflation over the years.

Recommendations on Tobacco Tax

- Implementing a substantial increase in tobacco tax

- The WHO recommended reducing affordability of tobacco products by a vast increase in tobacco tax. The tax rate should reach at least 75% of the retail price. There are about 41 countries (including Australia, France, Thailand, and the United Kingdom) abiding by the WHO’s recommendation.

- Establishing an automatic mechanism on raising tobacco tax

- To prevent the effect of tobacco tax from being eroded by inflation and income increment, nearly 30 countries have introduced an automatic mechanism on raising tobacco tax. Some of the countries increase the tax rate annually in line with the inflation rate automatically.

Country Policy on Tobacco Tax Australia A rise according to salary increment twice a year (Extra annual rise of 12.5% from 2013 to 2020)

Canada A rise according to inflation index every 5 years The United Kingdom An extra 2% rise above inflation rate annually Ukraine An annual increase of 20% from 2019-2025 Philippines An annual increase of tobacco tax from 2020 to 2023 and an automatic 5% increase since 2024

- To prevent the effect of tobacco tax from being eroded by inflation and income increment, nearly 30 countries have introduced an automatic mechanism on raising tobacco tax. Some of the countries increase the tax rate annually in line with the inflation rate automatically.

- Setting the minimum retail price or excise duty

- A minimum retail price of tobacco products could prevent the effect of tobacco tax from being weakened by the different retail prices in cigarettes of different brands. When the tobacco tax rate is set at a high level, smokers might switch to tobacco products in cheaper retail price, instead of quitting. The minimum retail price measure could maintain the retail price of different brands of tobacco products at similar level. Hence, smokers would be less likely to switch to cheaper brands and more likely to abstain from smoking. A research proved that the differences among brands of tobacco products become narrow after the introduction of the minimum retail price in the United Kingdom (UK).

- The UK and the European Union have set minimum excise duty to prevent retailers from paying fewer taxes by manipulating the retail price. For instance, tobacco tax in the UK is comprised of two components, one is the particular amount paid according to the number of cigarettes (£244.78 per 1,000 cigarettes) while another is a percentage (16.5%) of the retail price. Small-scale tobacco companies tend to manipulate the amount of payable tax by lowering the retail price. To prevent this, the UK government set a minimum excise duty (£320.90 per 1,000 cigarettes) and the sum of the two tax components should not lower than this level.

- Allocating the revenue from tobacco tax to public health or tobacco control policy

- According to the Government’s General Revenue Account in 2024-2025, the local tax revenue is expected to reach HK$9 billion. Allocating parts of the revenue to medical, healthcare and smoking cessation services could not only enhance the quality health services, but also provide more resources for and improve smoking cessation services, and thus reduce the smoking prevalence.

- There are 43 countries (including France, Iceland, Ireland, Philippines and South Korea) strategically allocating the revenue from tobacco tax to tobacco control or healthcare systems. For instance, more than one-third (36.4%) of the national healthcare expenditure in Philippines were sustained by tobacco tax revenue. This policy is feasible and practical.

Reference

Chen J, McGhee S, Lam TH. Economic costs attributable to smoking in Hong Kong in 2011: a possible increase from 1998. Nicotine Tob Res. 2019;21(4):505-512.

Goodchild, Mark & Nargis, Nigar & Tursan d'Espaignet, Edouard. (2017). Global economic cost of smoking-attributable diseases. Tobacco Control. 27. tobaccocontrol-2016. 10.1136/tobaccocontrol-2016-053305.

Jha P, Chaloupka F. J. (1999). Curbing the epidemic: Governments and the economics of tobacco control. Washington, DC: World Bank.

World Health Organization. (2010). WHO technical manual on tobacco tax administration. Geneva: World Health Organization.

World Health Organization. (2019). WHO report on the global tobacco epidemic, 2019: offer help to quit tobacco use. Geneva: World Health Organization.

World Health Organization. (2021). WHO technical manual on tobacco tax administration. Geneva: World Health Organization.